Condo Insurance vs. Homeowners Insurance: Key Differences

Protecting your home is crucial, but what type of insurance will do it better? That depends on your property. Homeowners need to cover the entire structure and surrounding property. Condo owners, however, only need to insure the interior of their units, as the exterior is typically covered by the homeowners association’s master policy.

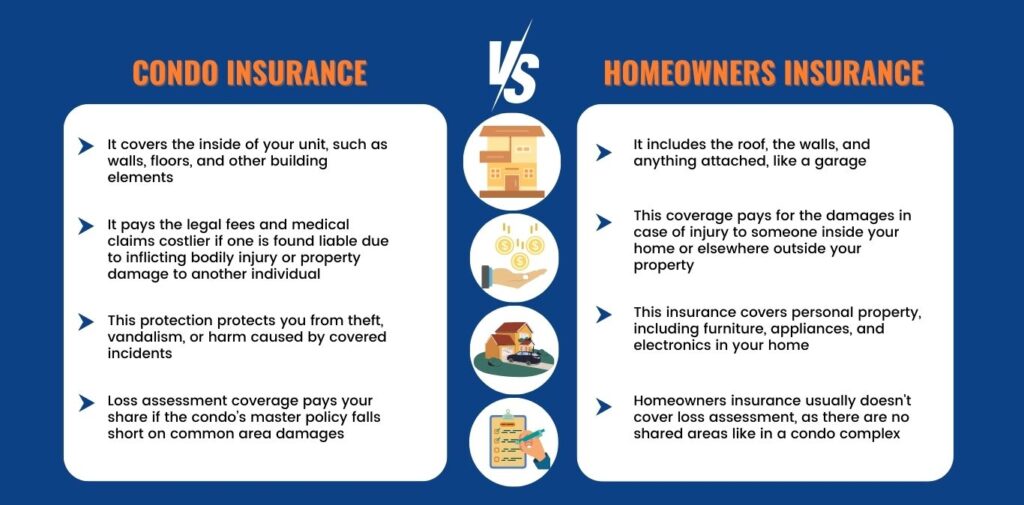

When deciding between condo insurance and homeowners insurance, it’s important to understand the key differences so you have your property fully protected. Although both kinds of insurance provide essential coverage- including liability protection and personal property coverage- the scope of each differs considerably.

What is Home Insurance?

Homeowners insurance is designed to protect your home and belongings from various risks, like damage or theft, while also offering liability coverage for accidents on your property. It covers both, interior and exterior damage, loss of personal items, and injuries that may occur on your premises.

Depending on the policy, home insurance generally covers various risks like fire, theft, vandalism, and some natural calamities. Standard home insurance policies include coverages for the actual structure, personal property, liability protection, and additional living expenses should the home become temporarily uninhabitable.

It’s always a good idea to talk to an insurance agent who can help you build the best policy for your needs because each house is unique. In addition, homeowners can extend their coverage with endorsements or other separate policies that provide flood or earthquake protection, which generally are not included in the standard home plans.

Also Read Condo Insurance(HO6) 101

Condo Insurance VS Homeowners Insurance

While condo insurance can insure the interior of your unit, including the walls, floor, and personal property, home insurance can cover the entire structure of your house, along with any attached features.

Understanding these distinctions is essential when choosing a condo or homeowners insurance policy that will best suit your living situation and property needs and provide you with complete financial protection against all kinds of perils that may arise.

Dwelling Coverage

- Condo Insurance: Condo insurance covers the inside of your unit, such as walls, floors, and other building elements. It usually protects against damage caused by fire, water damage, or destruction by others. However, it does not include general spaces and the outside areas of the building; these are generally under the protection of the condo association’s extensive policy.

- Homeowners Insurance: Homeowners insurance, or as some may say, house owner’s insurance, provides safety for all parts of your house. It includes the roof, the walls, and anything attached, like a garage. It guards against harm from fire, storms, or intentional damage. This coverage fully protects your house and home.

Liability Coverage

- Condo Insurance: Condo insurance covers liability for any injury that might occur inside the unit. It pays the legal fees and medical claims costlier if one is found liable due to inflicting bodily injury or property damage to another individual. Typically, such liability extends inside the interior space of your condominium unit.

- Homeowners Insurance: Homeowners insurance liability coverage pays for the damages in case of injury to someone inside your home or elsewhere outside your property. And it can also cover you against property damages arising from your actions.

Personal Property Coverage

- Condo Insurance: The assurance for condos safeguards personal items in your unit, like furniture, electronics, and clothes. This coverage protects you from theft, vandalism, or harm caused by covered incidents. It is necessary to evaluate the worth of your individual belongings to ensure the amount of coverage is ample.

- Homeowners Insurance: This insurance covers personal property for all interior things in your home, including furniture, home appliances, and other electronics. Like condo insurance, this type of coverage protects against theft or any damage due to covered events, and sometimes, it could be extended to personal property outside of your home, such as items in the garage or under the shade.

Loss Assessment Coverage

- Condo Insurance: In condominium insurance, the loss assessment coverage pays your share of the cost if the condominium association’s master policy does not pay total damages to the common areas.

- Homeowners Insurance: Homeowners insurance does not typically cover loss assessment since there are no shared areas, as would be the case in a condominium complex. In the rare case that homeowners are part of an HOA, an endorsement can be added to cover the owner’s share of assessments for community property repairs.

The Final Words

Understanding the fundamental differences in coverage between condo and homeowners insurance will make it easier to choose the right coverage. It can let you know your property is fully covered.

While condo insurance covers the interior of your unit, homeowners insurance covers the whole building. Both types offer liability and personal property protection but with different scopes of coverage.

For comprehensive and reliable coverage, you can contact Chicago’s most trustworthy insurance company, Abe GT & Associates. Specializing in tailoring the right coverage, Abe GT can find the most appropriate insurance for your condominium or home. Get in touch today to start the process—call us at 312-738-1384 for more information and assistance.